PoS Hardware & Software Support

Our Point-of-Sale Hardware and Software support service will ensure that your fleet of merchant card processing terminals is operating optimally.

Terminal Management Solution - Fully Managed

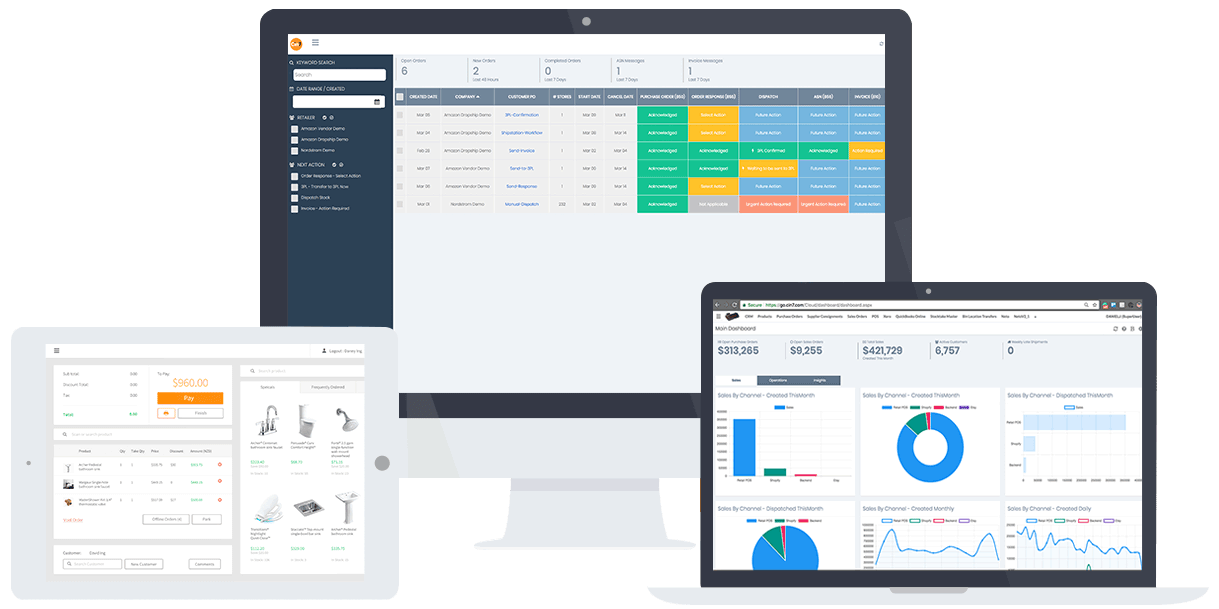

The next-tier of our solution is the TMS fully managed service which offers dashboards and real-time reporting and management of the PoS terminals. Proactive management ensures that your PoS fleet has continuous uptime and processing transactions so that you can maximize your ROI.

TMS with Agent Banking Platform (ABP)

The ultimate package in our service offering is geared towards financial institutions that can leverage our proven agent banking platform to promote financial inclusion. Contact us for a demo today.

Since 1993

Financial Inclusion and Agent Banking

Agency banking offers the prospect of much greater access to financial services for large numbers of currently unbanked or underbanked individuals – through financial institutions rolling out financial services using third-party agents. Technology has changed how banking is done across the world. Today, most transactions happen across the internet, enrollment documents are digitized, conferences are done through web conferencing platforms such as Skype and Teamviewer.

In developing countries, banking is still growing relative to the developed world. There are fewer PoS terminals, ATMs, branches and merchant payments. The use of informal or semi-formal financial services – cooperatives, deposit collectors and money lenders – is much higher. With the rapid adoption of technology is the developing countries, there is hope for the future.

Today, the PoS has enabled customers to have a new channel for banking within the reach of the individual’s dwelling place. PoS has become one of the building blocks for the success of agency banking today. It has proven that the banks can extend their services through agents, who are available to serve customers in remote areas. So, to the users, it is like a mobile ATM, which dispenses cash at tiered or flat commissions.

Agency banking is a channel and not a product. It just facilitates the transaction. For existing customers, agency banking risks being simply an additional channel for transactions, the customer would have completed anyway. It can facilitate new deposits and enable microloans. The features of PoS Banking include –

- The ability to operate within different platforms. This is the ability to move money from bank cards to different bank accounts and vice versa.

- New customers are easily acquired. Banks are going to gain more if they enroll new customers through PoS Banking. This will require not only digital identity but also the ability of these banks to open new accounts digitally at a minimal cost.

- Microlending is encouraged – microlending is traditionally not provided by commercial banks, but individuals, cooperatives and mobile money agents. Lenders are able to transfer funds to the borrowers through the involvement of a bank card and a PoS device.

- Cooperative savings – through the use of your debit card and a PoS, you can save money or make contributions in cooperative societies. You can do this without having to go the cooperative bank. On the side of the cooperative institution, it is advantageous to hold less cash. The digital money just goes through the PoS platform straight to the bank account.

- Cash withdrawals – individuals who live far from banks can access withdrawal services, without going to the banks. All you need is your bank card and an agent who offers PoS services. At developing nations, banking services are not adequate, especially in the suburbs, rural and surprisingly, the urban areas. PoS money dispensing services are now being encouraged by Payment Terminal Service Providers Today.

Next Steps...

Are you ready to see our demo? Get in touch with our team in Bangladesh by click on this link.